Article

Nov 17, 2025

New Fraud Trends: Prepare Your Business for 2026 & Beyond

Learn about six major fraud threats for 2026, from AI deepfakes to crypto scams, and see how to prepare your business against evolving risks.

Fraud is evolving fast, and many of the tactics that worked for years to stop it are no longer enough. Criminals are combining advanced technology with old-school tricks, creating schemes that are harder to detect and execute more quickly.

The scale of the problem is growing. The FBI’s Internet Crime Complaint Center (IC3) reported more than $12.5 billion in total fraud losses for 2024 across the United States, with AI‑driven schemes and investment scams leading the increases. LexisNexis data from 2025 shows that for every $1 lost to fraud, U.S. financial services firms face a true cost of $5.75 when remediation, replacement, and customer attrition are factored in.

Generative AI and deepfake tools mean identities can be convincingly faked in video calls or voice messages. Instant payment systems leave only seconds to identify and block suspicious transfers. Even long‑standing types of fraud, such as carding or check scams, are coming back with modern variations.

For businesses, the challenge is twofold. You need to understand the new ways fraudsters operate, and you need systems in place that can keep pace, adapt quickly and stop threats at the earliest stage.

In this article, we look at the major new fraud threats expected to grow in 2026, share the latest data behind them, and outline practical steps to protect your business.

Ready?

What Are the Most Significant New Fraud Threats in 2026

Fraud in 2026 is defined by speed, scale, and sophistication. New methods are powered by artificial intelligence, faster payment technology, and increasingly organized criminal networks. Many attacks combine multiple tactics in one, making them harder to detect with traditional security measures.

Below are the key threats experts expect to shape the fraud landscape in the year ahead.

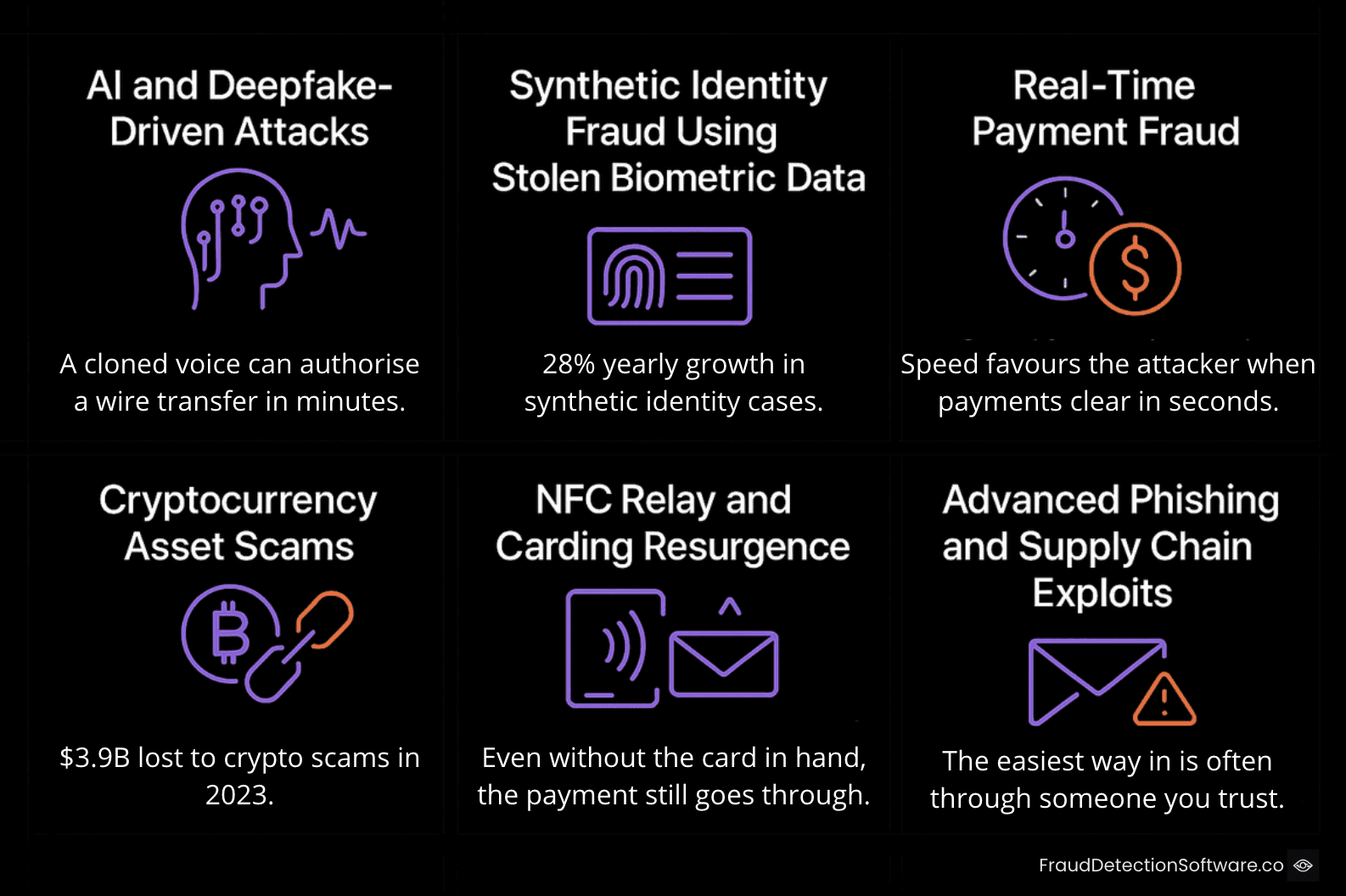

AI and Deepfake‑Driven Attacks

Generative AI is now a core part of modern fraud. Criminals use it to produce phishing emails and fake documents that appear legitimate, often tailored with insider‑level detail. Deepfake technology makes these attacks even more dangerous. It can produce realistic videos and cloned voices that are convincing enough to authorise transfers or pass security checks.

A notable example is camera injection, where fake video streams bypass facial recognition systems without liveness detection. The FBI has warned of deepfake‑assisted business email compromise incidents capable of diverting hundreds of thousands of dollars in a single hit.

Europol’s Programming Document 2024–2026 predicts AI‑enabled social engineering will become increasingly autonomous, able to run multiple scams at once and adjust scripts in real time based on a victim’s responses. Without tools to detect synthetic media, critical workflows such as remote onboarding are at high risk of being compromised.

Synthetic Identity Fraud Using Stolen Biometric Data

Synthetic identity fraud blends genuine details with fabricated information to create an identity that looks authentic. Criminals may use real names, addresses, or national ID numbers, adding fake data to bypass standard checks.

In recent years, these fabricated identities have become more convincing thanks to stolen biometric data. Faces, fingerprints, and even behavioural patterns (like touchscreen swipes or typing rhythms) can be captured through malware, phishing, or compromised systems. This data is then used to strengthen fake profiles so they can pass remote onboarding and Know Your Customer (KYC) processes undetected.

Europol warns that synthetic identity fraud remains one of the fastest‑growing forms of financial crime, with cases increasing 28 percent year‑on‑year in their most recent trend data. Once a synthetic identity is accepted by a bank or service provider, it can be used to open accounts, build credit, and conduct transactions, often for months before detection.

This creates a long‑term fraud risk — each successful synthetic profile becomes a “sleeper account” that criminals can activate later for high‑value theft, money laundering, or further identity manipulation.

Real‑Time Payment Fraud

Instant payment systems give customers speed and convenience. They also give fraudsters an opportunity to exploit the tiny detection window before funds leave an account.

One common tactic is authorised push payment (APP) fraud. Criminals use social engineering to trick victims into sending money themselves — often by posing as a trusted company or authority. Since the transaction is initiated by the actual account holder, traditional fraud detection systems are far less likely to flag it in time.

With payments settling in seconds, the gap for intervention is almost zero without automated, real‑time monitoring. PwC’s Global Digital Trust Insights for 2026 warns that financial institutions see real‑time payment fraud as one of the hardest threats to counter without AI-powered tools capable of instant risk scoring.

For businesses that rely on instant transfers, prevention must shift from reviewing transactions after completion to assessing risk before approval, ideally while the customer is still interacting with the system.

Cryptocurrency Asset Scams

Fraud in cryptocurrency markets is adapting quickly. Scams now blend social engineering, investment hype, and technical manipulation to deceive victims across borders.

One increasingly common scheme is pig butchering. Criminals form a relationship with the victim (often through social media or dating platforms), then slowly convince them to invest in fake crypto projects. Others run Ponzi-style token launches, paying early participants with deposits from newcomers before disappearing with the remaining funds.

The FBI’s IC3 report recorded over $3.9 billion in reported losses from cryptocurrency scams in 2023, a figure that has continued to rise as valuations increase and new victims enter the market. Recovery is extremely difficult. Transactions are irreversible, assets can be moved or laundered through mixers quickly, and jurisdictional challenges slow down law enforcement.

For organisations dealing with crypto payments or investments, prevention depends on strict KYC processes, blockchain analytics to track suspicious wallets, and continuous monitoring for patterns associated with known scam types.

NFC Relay and Carding Resurgence

Card fraud, once thought to be in decline, is reappearing with new, digital twists. A common tactic is converting stolen card data into Apple Pay or Google Wallet accounts to enable tap‑to‑pay transactions without the physical card. This lets fraudsters use compromised payment credentials in stores or on contactless-enabled terminals worldwide.

The newer threat is NFC relay attacks. Here, a compromised mobile device or specialised tool intercepts and relays payment data between two devices. A criminal at one location can use the victim’s credentials to make purchases elsewhere, even if the card or phone never physically leaves the victim’s possession.

Many point‑of‑sale networks still lack checks for unusual geographical patterns or robust device fingerprinting. In practice, that means tokenised card data in a mobile wallet can be used in multiple locations without raising an alert — unless systems are upgraded to spot those anomalies.

For businesses, defence often means adding device fingerprinting, flagging high-risk provisioning processes for digital wallets, and using transaction anomaly detection to block suspicious tap‑to‑pay activity before it clears.

Advanced Phishing and Supply Chain Exploits

Phishing has evolved far beyond clumsy emails full of mistakes. Criminals now use AI to create messages that are context‑specific, typo‑free, and aligned to the tone of the target organisation. These emails can reference actual projects, events, or individuals, making them far more convincing than the generic scams of the past.

Some threat actors take it further with impostor support chats or fake portals that perfectly mimic legitimate systems. Nation‑state groups and organised crime networks are using these methods not just to steal credentials, but to plant malware and gain deeper access over time.

Supply chain exploits add another layer of risk. Instead of attacking a company directly, criminals compromise a trusted vendor, contractor, or software provider. Once inside that network, they use access privileges to reach their ultimate target. This approach bypasses perimeter defences because the attack comes from an entity the organisation already trusts.

Defences against these threats rely on authentication that cannot easily be spoofed, vendor risk assessments, and layered monitoring to detect anomalies in user behaviour and access patterns — even when those actions appear to come from a trusted partner.

How Businesses Can Prepare for Emerging Fraud Trends

Stopping fraud in 2026 means acting before threats have the chance to cause damage. The following measures help businesses protect themselves against both new and evolving attack methods:

1. Strengthen Onboarding Security

Use document and identity verification at the very start of customer and vendor relationships. Layer visual forensics, metadata checks, and biometric verification to block synthetic identities before accounts are opened.

2. Apply Multi‑Layered Defences

Combine behavioural analytics, device fingerprinting, and liveness detection. Each layer makes it harder for fraudsters to adapt and slip through.

3. Monitor in Real Time

Move from post‑transaction reviews to continuous monitoring with instant risk scoring. This is key for real‑time payment systems where the fraud window is measured in seconds.

4. Protect the Supply Chain

Regularly assess vendor risks and set strict authentication requirements for partner systems. This stops attackers who gain entry through trusted third parties.

5. Educate and Empower Staff

Train employees to spot and report suspicious activity or communications. Make reporting mechanisms easy and secure to encourage swift action.

6. Avoid Siloed Security Operations

Share fraud intelligence across departments such as fraud, compliance, and cybersecurity. When teams work in isolation, attackers exploit the gaps.

Practical readiness is not about one tool but a combination of proactive measures working together. The goal is to detect and block fraud at the first opportunity, whether it comes in through a transaction, an onboarding document, or a trusted partner’s system.

Why Document and Identity Verification Are Your First Line of Defence

Many fraud schemes begin with false information. Whether it is a synthetic identity, a tampered invoice, or a deepfake video used to pass onboarding, the first point of contact is often where fraudsters slip in. If this stage is weak, the rest of the security framework is more vulnerable.

Strong document and identity verification tools stop threats before they can escalate. By applying forensic checks to every document, from invoices to ID cards, businesses can detect metadata inconsistencies, missing data fields, signs of image manipulation, or AI‑generated content patterns. These checks filter out suspicious submissions at the start of the process.

Identity verification adds another layer of security. Biometric matching, NFC passport chip reads, and secure liveness detection ensure that the person behind the document is genuine and physically present. This shuts down synthetic identity fraud and account takeover attempts before they pass KYC.

FraudDetectionSoftware brings these capabilities together in one automated workflow, delivering instant risk scores, complete reports, and integrations with more than 200 systems. That means onboarding, compliance checks, and approvals can be secured without slowing down legitimate customers or partners.

Investing in front‑line verification pays off. It prevents fraud at its earliest stage, reduces downstream investigation costs, and protects both your margins and your reputation.

Preparing Now for 2026 and Beyond

Fraud in 2026 will move faster, hit harder, and be harder to detect with reactive approaches. Criminals are using tools that think, adapt, and disguise themselves, while attack surfaces expand through mobile payments, instant transfers, and complex supply chains.

The most effective defence is preparation. Understanding the main threats, from AI‑driven scams and synthetic identities to real‑time payment fraud, allows you to choose protections that match the speed and sophistication of modern attacks. That means securing the first point of contact with document and identity verification, layering analytics to spot anomalies, and monitoring continuously in real time.

For businesses, the choice is clear. Acting now avoids being caught off guard later, when threats have scaled and simple checks no longer stop them. The organisations that invest in adaptive, integrated protection today will be the ones ready to face whatever fraud looks like tomorrow.

Ready to block document and identity fraud before it starts? Book a free demo with FraudDetectionSoftware and see how our AI-powered checks work in real time.